Paramount and Skydance Media to Merge in $8 Billion Deal Amidst Market Uncertainty

Paramount Global has announced a merger with Skydance Media valued at $8 billion, set to finalize in 2025. The merger signifies a strategic acquisition for Paramount, incorporating Skydance’s diverse portfolio and leadership into its fold. However, the market’s reaction has been mixed, reflecting uncertainties and potential opportunities ahead.

Under the terms of the deal, Paramount will acquire Skydance Media, a company known for its successful ventures in film and television. Notably, Skydance will acquire Shery Redstone’s 70% interest in National Amusements, a critical stakeholder in the merger. Post-merger, leadership responsibilities will be primarily assumed by Skydance, indicating a shift towards integrating Skydance’s operational philosophies and strategies within Paramount’s broader framework.

The deal includes a clause allowing Paramount to shop for a better offer within a 45-day window, potentially inviting higher bids and greater valuation for the company. This period provides a window of opportunity for other industry players to make competitive offers.

The announcement has led to a cautious response from the stock market. CFRA Research analyst Kenneth Leon downgraded his rating of Paramount’s stock from “buy” to “hold,” reflecting a tempered outlook amid the merger news. Additionally, Leon adjusted his price target for Paramount stock, reducing it by $4 to $12. This downgrade indicates market concerns over the financial stability and strategic direction of the merged entity.

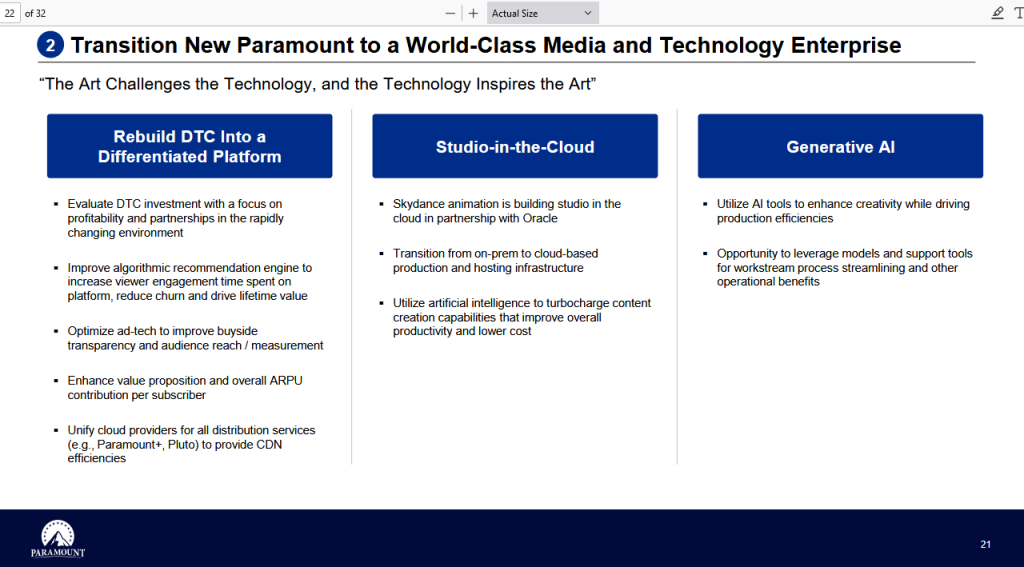

One of the significant challenges facing the merged entity will be addressing losses from direct-to-consumer (DTC) offerings. As streaming services continue to reshape the entertainment industry, finding a profitable model for DTC services remains a critical issue. Paramount and Skydance will need to innovate and potentially restructure their DTC strategies to stem financial losses and achieve sustainable growth.

Additionally, leveraging and licensing intellectual properties (IPs) will play a crucial role in the merged company’s strategy. Skydance’s extensive experience in content creation could provide valuable insights and opportunities for optimizing IP utilization, driving both revenue and audience engagement.

As the merger progresses, the industry will closely watch how Paramount and Skydance integrate their operations and strategies to achieve long-term growth and stability… possibly.

+ There are no comments

Add yours